In 2023, the VR headset market in China experienced a year-on-year decline of 61%, marking the largest drop in the past five years. In contrast, shipments of AR smart glasses in China increased by 64% year-on-year. What factors led to the opposite growth trends in the Chinese VR and AR smart glasses markets? Looking ahead, what can we expect? Let's explore these questions below.

Analysis of the VR Market in China - 2023

In the first half of 2023, the Chinese VR market witnessed a year-on-year decline of 56%, which worsened to 65% in the second half of the year. In the latter half of 2023, shipments of VR headsets in China dropped by 4% compared to the previous period. Consumer-level demand for VR in China weakened during the second half of 2023, while the enterprise-level market showed some resilience.

Data Source: Counterpoint China XR Market Tracker

Due to the impact of ByteDance, Pico VR's shipments in China declined by 19% in the second half of 2023. Sales momentum of PSVR 2 slowed down in China, with Sony's shipments decreasing by 46% compared to the previous period in the latter half of 2023. However, DPVR, primarily catering to the enterprise market, saw a 121% increase in shipments in the second half of 2023. Development of other brands in the Chinese VR sector remained relatively flat.

Analysis of the AR Smart Glasses Market in China - 2023

In contrast to the sluggish performance of the Chinese VR market, the AR smart glasses market in China experienced robust growth in 2023, with a year-on-year increase of 64%. The main factors driving market growth include:

-

- The aggressive new product release strategies employed by leading manufacturers

- Advancements in optical technology, design aesthetics, and ergonomic engineering of AR glasses products

- Enhanced compatibility with a wider range of devices

- Brands actively expanding offline channels and increasing marketing investments

Data Source: Counterpoint China XR Market Tracking Service

Note: In Counterpoint's sales tracking, AR smart glasses only include glasses that support optical transparency functions. Smart glasses without displays are not included in this tracking data.

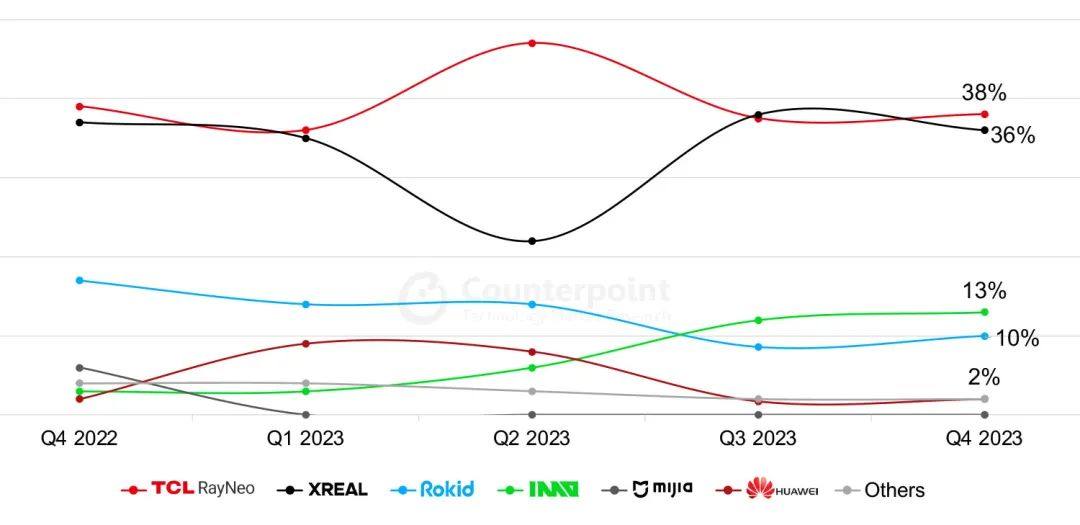

TCL Thunderbird and Xreal led the Chinese AR smart glasses market throughout 2023.

- TCL雷鸟In 2023, TCL Thunderbird saw a year-on-year shipment increase of 126%, securing the top position in the Chinese AR smart glasses market. TCL Thunderbird promoted three main products during the year: Thunderbird Air 1S, Thunderbird Air Plus, and Thunderbird Air 2. These products quickly became the best-selling products in the Chinese AR smart glasses market during their promotional period.

- Xreal emerged as the second-largest AR smart glasses manufacturer in the Chinese market in 2023, with a year-on-year growth of 135%. Xreal's marketing strategy was notably aggressive, and the company demonstrated excellent performance in optimizing product lifecycle management.

- primarily targeting the enterprise-level marketRokidranked as the third-largest AR glasses manufacturer in China in 2023. Meanwhile, Shadow Creator Technology, a pioneer in commercial waveguide solutions, achieved a year-on-year growth of over 200% in 2023.

In addition to existing leading manufacturers, new players also contributed to the development of the Chinese AR smart glasses market in 2023. These newcomers include Meizu, which launched the MYVU smart glasses, ARknovv, which introduced the A1 smart glasses, and Liweike, which released the Meta Lens S3 smart glasses.

Outlook for the Chinese AR/VR Market

In 2023, Apple launched the long-awaited Apple Vision Pro, yet failed to ignite a new "metaverse" craze in China. However, with its official release in China in 2024, Chinese developers are expected to innovate applications, injecting new vitality into the VR market. Alibaba and its subsidiaries, including DingTalk, Tencent, Ctrip, and MiHoYo, have announced plans to develop spatial computing applications for Apple Vision Pro. Nonetheless, we anticipate that the immediate impact of Apple Vision Pro and other VR/MR (mixed reality) products released in the Chinese market in 2024 on sales growth will remain limited.

The Chinese AR smart glasses market is expected to maintain its growth momentum, despite its current small base. It is anticipated that in 2024, more AR smart glasses using waveguide solutions will be commercialized, offering richer experiences for outdoor applications and life assistance scenarios. In the future, with continuous advancements in AR display and optical solutions, processors, wireless connectivity technologies with other devices like smartphones and computers, as well as improvements in user interfaces and applications, the AR smart glasses market is expected to experience further growth.

原文始发于微信公众号(Counterpoint Research):Insights into the Chinese XR Market in 2023 and Outlook for 2024